Read time 8 min

Read time 8 minIn commercial real estate, Common Area Maintenance (CAM) reconciliation is not just accounting; it’s a critical cost-control point for tenants and a compliance requirement for landlords. This is done by comparing the estimated CAM fees that tenants pay each month with the actual costs that the landlord has to pay to keep common areas like lobby areas, parking lots, landscaping, and security up to code. The difference is either billed or refunded.

These charges can significantly impact tenants’ operating expenses. For instance, while CAM costs in upscale retail establishments can surpass $20/sq.ft., they usually fall between $8 and $15 per square foot in office buildings. Yet ambiguity in lease terms often leads to disputes; over 70% of tenants contest at least part of their CAM reconciliation each year.

The structure of your lease, whether it’s Triple Net (NNN), Modified Gross, or Full-Service, directly affects how CAM is allocated and reconciled. Knowing these differences is important for keeping your business ready for audits, reducing your risk, and keeping your cash flow in check.

Any business that is looking at or managing a commercial lease needs to know about Common Area Maintenance (CAM). CAM charges are not just ancillary costs; they’re a substantial financial component that, if unmanaged, can lead to unplanned expenditures and reconciliation disputes.

At Springbord, we support clients through comprehensive CAM reconciliation services, including lease abstraction, expense audit support, and digital reconciliation management. Our technology-backed solutions help simplify compliance, reduce overcharges, and bring clarity to complex lease structures.

In this blog, we’ll examine how CAM reconciliation operates across lease types and what business owners should do to stay financially protected.

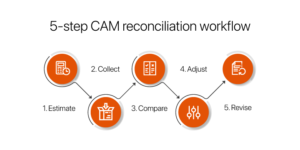

The CAM Reconciliation Process

The CAM reconciliation process is a structured, multi-step process that makes sure that tenants’ shared maintenance costs are split correctly. Every step is very important for keeping things clear about money and following the terms of the lease.

1. Estimating Annual CAM Charges

At the start of the lease year, landlords prepare an estimated CAM budget based on projected operating and maintenance expenses for shared areas (e.g., landscaping, lighting, security). The rent that tenants are charged throughout the year is based on this estimate.

2. Monthly Prorated Collections

Tenants are billed monthly for their pro rata share of the estimated CAM charges. These payments are typically included with rent and based on the square footage or agreed-upon allocation methods defined in the lease.

3. Year-End Reconciliation: Actual vs. Estimated

At the end of the lease year, landlords calculate the actual CAM expenses incurred. These are compared against the total estimated payments collected from each tenant throughout the year. This comparison identifies any overpayments or underpayments.

4. Issuing Credits or Shortfall Invoices

If tenants overpaid, the excess is credited or refunded. If underpayments are identified, landlords issue invoices for the balance due. This ensures that landlords recover the full cost of maintaining the property, while tenants pay only their fair share.

5. Adjusting Future CAM Estimates

Based on actual costs, landlords revise the next year’s CAM estimates to improve forecasting accuracy. This helps reduce large reconciliation swings in future cycles and fosters clearer financial expectations.

At Springbord, we provide services for CAM reconciliation that use data to ensure costs are accurately divided and that all lease terms are followed, including tasks like summarizing leases, analyzing differences, checking documents, and supporting audits.

How CAM Reconciliation Applies to Different Commercial Real Estate Lease Types

Commercial leases vary significantly in how they allocate and reconcile Common Area Maintenance (CAM) expenses. These differences impact how tenants budget for occupancy costs and how landlords recover operational expenditures. Misunderstanding CAM terms across lease types can lead to unexpected charges, disputes, and audit risks. A clear grasp of how reconciliation is handled across lease structures is essential for accurate forecasting, lease compliance, and maintaining equitable cost-sharing practices.

Below, we explore how CAM reconciliation functions in the most common commercial lease formats.

1. Triple Net (NNN) Lease

In a Triple Net (NNN) lease, the tenant is contractually responsible for 100% of CAM charges, in addition to property taxes and insurance. This lease structure is common in retail, industrial, and medical office properties, particularly where landlords aim to stabilize cash flow by passing through all variable property costs to tenants.

- Landlords provide annual CAM budgets that tenants pay in monthly installments, based on their pro-rata share of leased space.

- Landlords do reconciliation at the end of the year to see if their estimated CAM costs match their actual operating costs.

- If actual costs exceed estimates, tenants are invoiced for the difference; if less, tenants receive a credit or refund.

Strategic Consideration:

Given the lack of cap protections, tenants should negotiate for:

- Caps on controllable CAM (e.g., 3–5% annually)

- Exclusions for capital expenses unless amortized and lease-defined

- Detailed audit rights and timelines to validate year-end reconciliation

Springbord offers NNN tenants reconciliation audits, cost modeling, and lease clause verification to ensure full transparency and compliance.

2. Full-Service Gross Lease

Tenants in a full-service gross lease pay one base rent that covers all costs, such as property taxes, insurance, utilities, and CAM. This model simplifies monthly billing but still involves indirect CAM reconciliation through expense stop clauses.

- Rent covers all building operating expenses up to a defined threshold (the “stop”).

- If annual CAM exceeds the stop, the excess is billed to tenants based on their share.

- These reconciliations are not always itemized unless requested, which can mask non-operating cost inclusion.

Expense stops typically reflect the building’s costs during the lease’s base year. According to Visual Lease, escalations from this baseline are often pegged to inflation or operational cost increases.

Strategic Consideration:

Tenants should:

- Review how expense stops are calculated and reset

- Insist on breakdowns of escalated costs

- Negotiate exclusions for capital improvements or administrative overhead

Springbord supports tenants with lease abstraction, expense clause validation, and CAM escalation tracking across gross leases.

3. Modified Gross Lease

A modified gross lease blends elements of both gross and NNN models, offering tenants a fixed rent structure plus limited shared expense responsibilities. The most common arrangement involves a base-year stop, where tenants only pay CAM that exceeds the building’s costs during the first lease year.

- Tenants are billed for shared expenses exceeding base-year benchmarks (e.g., increases in janitorial, security, or HVAC maintenance).

- At reconciliation, landlords calculate actual CAM, compare it against base-year figures, and pass through excess amounts.

Risks arise when landlords inflate the base year, setting a high threshold and avoiding future pass-throughs, only to adjust or misallocate expenses later.

Strategic Consideration:

To maintain fairness and accuracy, tenants should:

- Obtain and retain detailed base-year expense reports

- Define what qualifies as operating vs. capital costs

- Ensure CPI-based escalations are capped or tied to actual expenses

Springbord offers base-year modeling and variance tracking services to help clients challenge inflated benchmarks and monitor compliance.

4. Percentage Lease

Most commercial properties have percentage leases, where tenants pay a base rent plus a share of the gross sales. CAM reconciliation applies differently based on how CAM is integrated into the lease.

- In dual-structured leases, CAM is charged separately and reconciled annually.

- In blended leases, CAM may be bundled into percentage rent, reducing visibility into individual cost components.

CAM charges in percentage leases can still be significant, particularly in high-footfall locations where operational maintenance costs (e.g., parking lot cleaning, landscaping) increase with traffic volume.

Strategic Consideration:

Tenants should:

- Confirm whether CAM is billed separately or within rent

- Request itemized CAM statements if separate billing is used

- Monitor how shared costs scale with store traffic and sales growth

Springbord helps retail tenants understand percentage lease structures, isolate CAM from percentage rent, and validate year-end reconciliations.

5. Absolute Net Lease

A tenant who signs an absolute net lease is in charge of covering all property-related expenses. This includes CAM, taxes, insurance, capital repairs, and structural maintenance without landlord participation.

- There is typically no CAM reconciliation, as the tenant manages costs directly.

- These leases are common in single-tenant buildings, often occupied by national brands or essential-service businesses.

The renter assumes operational risk and pays the rent under an absolute net lease. Any surprise expenses, like roof replacement or utility overhauls, must be managed entirely by the occupant.

Strategic Consideration:

Tenants must:

- Conduct thorough due diligence on building condition pre-signing

- Budget for long-term capital repairs and maintenance

- Secure detailed maintenance logs from the landlord before possession

Springbord supports tenants by analyzing lease data, performing cost benchmarking, and validating capital exposure for absolute net lease scenarios.

6. Bondable Lease

A bondable lease, sometimes called a “hell-or-high-water lease,” is the most stringent form of commercial lease. It is similar to an absolute net lease but with non-cancelable and non-negotiable obligations.

- Tenants are responsible for all operating and capital expenses, regardless of building condition or unforeseen circumstances.

- There is no CAM reconciliation, since all obligations are handled directly by the tenant without landlord support.

This structure is typically used in long-term investment-grade leases (e.g., drugstores, logistics hubs), offering landlords high revenue predictability and zero expense obligations.

Strategic Consideration:

Tenants must:

- Plan for multi-decade capital planning

- Ensure their operational model can withstand unexpected infrastructure risks

- Consider insurance structuring and reserves for extreme scenarios

In bondable lease agreements, Springbord collaborates with clients to model long-term operational obligations, evaluate risk exposure, and guarantee the efficient abstraction and management of lease data.

At Springbord, we offer tailored CAM solutions across all lease types, including lease abstraction, reconciliation support, cost modeling, and portfolio-wide audits, empowering tenants and landlords to manage CAM with accuracy and confidence.

Conclusion

CAM reconciliation is more than a year-end task; it’s a vital process for controlling costs, maintaining lease compliance, and ensuring financial transparency between landlords and tenants. With varying lease types and complex cost-sharing structures, even small oversights can lead to disputes, overpayments, or missed recoveries.

That’s why a structured, detail-oriented approach is essential.

At Springbord, we bring clarity and consistency to CAM reconciliation through a full-service model, covering everything from accurate lease abstraction to billing validation and audit support. By By By centralizing data and applying expert analysis, we help our clients reduce risk, ensure compliance, and optimize cost recovery across their portfolios.

Want to take the complexity out of CAM reconciliation?

Partner with Springbord to streamline the process and gain full visibility into your lease obligations and recoveries.

FAQ

1. What is CAM reconciliation in commercial real estate?

It’s the process of comparing estimated CAM charges paid by tenants with the landlord’s actual expenses for common areas.

2. Why do CAM charges often cause disputes?

Ambiguity in lease terms and lack of transparency lead to errors—over 70% of tenants contest CAM reconciliations yearly.

3. How does CAM reconciliation differ across lease types?

Lease structures like NNN, Full-Service, or Modified Gross define how CAM is billed, shared, and adjusted at year-end.

4. What happens if tenants overpay or underpay CAM charges?

Overpayments are credited/refunded, and underpayments are billed through shortfall invoices after reconciliation.

5. Why is CAM reconciliation important for tenants and landlords?

It ensures fair cost-sharing, prevents disputes, improves compliance, and helps both parties manage cash flow.

6. Who should be most concerned about CAM reconciliation?

Landlords, property managers, tenants, and REITs—all need clarity to avoid revenue loss or unexpected expenses.

7. How does Springbord support CAM reconciliation?

Springbord offers lease abstraction, audits, and digital reconciliation tools to reduce overcharges and simplify compliance.