Read time 5 min

Read time 5 minWhen did you last closely examine the costs associated with common area maintenance (CAM)?

For many business owners, CAM fees are unavoidable in leasing commercial property, but they are often obscured by complexity and hidden costs. Overcharges can easily be overlooked due to ambiguous line items and suspicious expense allocations. But are you paying more than your fair share? Regaining control over your bottom line is the goal of comprehending and controlling your CAM charges, not just cutting costs.

This blog will explain the CAM fees in detail, point out the most frequent mistakes resulting in overpayments, and provide sophisticated tips to ensure you are only paying what is required. Let us find out if you are truly aware of your CAM charges—or if your business is quietly losing money.

CAM Charges for Business Owners

Common Area Maintenance (CAM) charges are fees associated with maintaining shared spaces in a commercial property, such as parking lots, hallways, landscaping, and security services. Tenants usually share these costs based on their lease terms, but these can vary greatly. The complexity and variability of these charges make them an important aspect of lease management.

Why You Should Care?

Recent studies indicate that up to 10-15% of tenants may be overpaying on their CAM charges due to unclear expense allocations. Issues arise when landlords include vague categories like “general maintenance” or inappropriate expenses like property management fees under CAM charges. For businesses, even a minor overcharge can lead to a significant financial drain.

The Financial Impact

Consider a midsized retail business occupying 10,000 square feet in a shopping centre. The annual CAM fees could easily reach tens of thousands of dollars. If a portion of these charges is inaccurate, the business’s bottom line could be directly affected. It is important to comprehend and manage CAM charges to maintain fair business practices and financial control, not just to save expenses.

Avoiding Overpayment

Businesses need a strategic approach to manage CAM charges effectively. This includes understanding lease terms, regularly reviewing charge statements, and challenging discrepancies.

Springbord offers expert CAM charge audits and lease management solutions to bring transparency and cost efficiency to your leasing expenses.

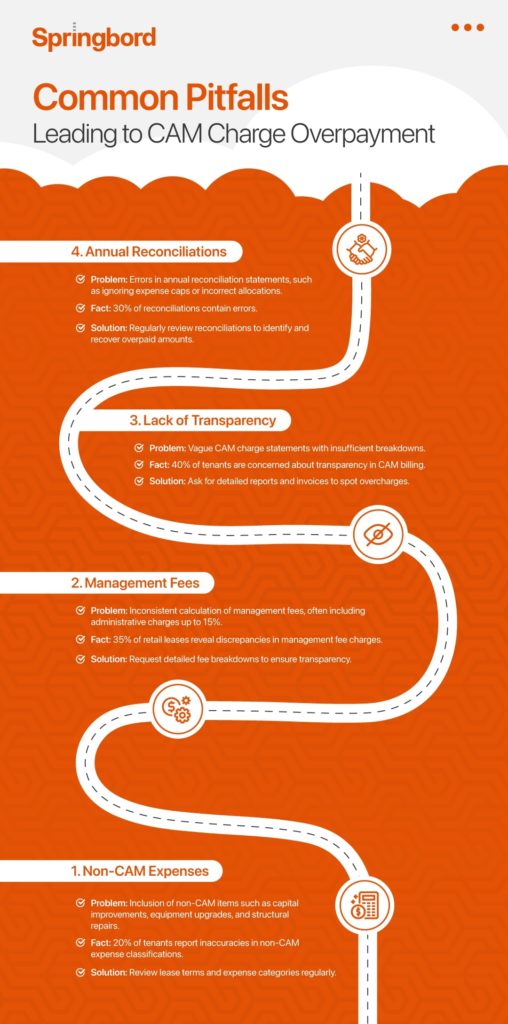

Common Pitfalls: Why You Might Be Overpaying

Common Area Maintenance (CAM) charge overpayment is a common problem that can have a big effect on a company’s bottom line.

Various factors contribute to this problem, often rooted in the lack of transparency and complexity of CAM fee structures. Let us look at some of the most common pitfalls that lead to overpayment.

Non-CAM Expenses

One of the most common issues is the inclusion of expenses that should not be classified as CAM charges, such as capital improvements, equipment upgrades, or structural repairs. Over 20% of commercial tenants report inaccuracies related to non-CAM expenses in their statements. Reviewing lease terms and expense categories is critical to ensuring compliance and avoiding unnecessary costs.

Management Fees

Management fees are often included in CAM expenses, but their calculation can vary significantly. Some landlords charge a flat percentage, while others add extra administrative fees, sometimes as high as 15%. Audits reveal discrepancies in 35% of retail leases involving management fees. Tenants must examine lease agreements and request breakdowns to prevent overcharges.

Lack of Transparency

Many landlords provide vague CAM charge statements, lacking detailed breakdowns of expenses. This makes it challenging to verify charges. A survey by IREM found that 40% of tenants are concerned about the lack of transparency in CAM billing. Requesting detailed reports and invoices can help identify discrepancies.

Annual Reconciliations

Errors in annual reconciliation statements can lead to overpayments, such as ignoring expense caps or incorrect cost allocation. Studies show that 30% of annual reconciliations contain errors. Regularly reviewing these statements can help recover overpaid amounts.

To make sure your company is not overpaying, Springbord provides professional CAM charge audits. We do this by using our industry knowledge and data analysis to find discrepancies, examine management fees, and confirm annual reconciliations.

Strategies to Review and Reduce CAM Charges

Controlling Common Area Maintenance (CAM) charges requires a strategic approach. Here are advanced methods to help identify and mitigate overpayments.

Audit Your Lease

The first line of defence against CAM overcharges is a thorough understanding of your lease terms. Leases often contain detailed language regarding what expenses are included in CAM charges, how they are allocated, and whether there are caps on increases.

Identify Caps and Exclusions: Check the lease for expense caps (e.g., management fees) and specific exclusions, such as capital improvements. Check to make sure your pro-rata share of CAM costs has been calculated accurately.

Industry Insight: 50% of CAM-related disputes stem from lease misinterpretation. A detailed lease review is crucial for spotting discrepancies.

Request Detailed Breakdowns

Landlords often provide lump-sum CAM charges with limited expense breakdowns, which can conceal overcharges or misallocated expenses. Requesting detailed statements is necessary.

- Ask for Itemized Reports: Request line-by-line breakdowns of all expenses. Identify any unrelated charges like capital improvements or equipment replacements.

- Examine Invoices: Request invoices for major expenses to ensure they are properly categorized.

Tip: Tenants who request detailed breakdowns can recover up to 15% of annual CAM costs.

Conduct CAM Audits

A third-party CAM audit is one of the most effective ways to identify overcharges. Lease audits are conducted by professionals who specialize in analyzing CAM charges, lease terms, and expense allocations.

- Identify Discrepancies: Auditors can find pro-rata shares, improperly applied caps and non-CAM expenses.

- Recover Overpayments: In many cases, audits result in the recovery of substantial overpayments. According to IFMA, CAM audits can yield savings of up to 25%.

Springbord specializes in CAM audits, helping clients identify discrepancies and recover overpayments.

Negotiating Lease Terms

Negotiating lease terms at the outset or during renewal is a critical strategy for managing CAM expenses.

- Set Caps: Include specific caps on annual CAM increases to limit potential cost escalation. Fixed or percentage caps provide predictability in budgeting for CAM expenses.

- Specify Exclusions: Clearly outline what expenses are excluded from CAM charges, such as capital expenditures, legal fees, or marketing costs, to avoid unexpected charges.

- Increase transparency: Negotiate for a clause that requires landlords to provide detailed annual reconciliations, including itemized expense reports.

Insight: Proactive lease negotiation can reduce annual CAM expenses by up to 20%.

To properly manage CAM charges and ensure transparency and cost savings, Springbord provides lease review, CAM auditing, and negotiation support services.

Conclusion

Maintaining the financial stability of your company depends on your ability to manage CAM charges effectively. You can avoid overpaying and take back control of your spending by being aware of your lease terms, asking for thorough expense breakdowns, performing audits, and negotiating lease terms.

With the complexities of CAM charges, precaution is necessary. Take control of your CAM charges today.

Contact Springbord to discover discrepancies, recover overpayments, and bring clarity to your CAM billing. To begin optimizing your CAM expenses, get in contact with Springbord right now!